Learning money skills for young people is one of the most important things we can teach in school, but most of us never got those lessons.

If you think back to your school days, how much do you actually remember learning about money? For most of us, the answer is “not much”. Maybe a few lessons on coins and change, or some quick maths problems about how much Sally’s apples cost.

But the truth is, our money habits start forming way before we ever get our first paycheque.

Money Habits Start Early

Research shows that by age 6 or 7, we’ve already started forming attitudes and habits around money. Whether it’s how we see saving, spending, or even talking about money, those early years matter. Kids pick up cues from parents, adverts, and what they see at school, long before they ever open a bank account. This could be beneficial for teaching money skills to young people.

Studies show that children’s attitudes to money are shaped by age 7, and small habits (like saving a little pocket money regularly) can set the foundation for lifelong financial wellbeing.

The Value of Money is More Than Just Numbers

But it’s not just about knowing how money works, it’s about understanding why it matters. Money, on its own, is just paper or numbers on a screen. You have to remember, it only has value when you use it. Whether that’s buying something you need, saving for the future, or supporting someone else.

Teaching money skills to young people and the value of money means showing them that:

Why Contribution Matters

When you earn or receive money, you have a choice: keep it, spend it, or use it to make a difference. Learning to contribute, whether that’s helping out at home, supporting a friend, giving to charity, or even paying tax, teaches us responsibility and empathy.

Paying tax is often misunderstood, but it’s actually a sign of success. It means you’ve earned enough to give back and support the things we all rely on: schools, healthcare, roads, and community services. Contributing through tax isn’t just an obligation, it’s a way of building the kind of world you want to live in.

Research shows that young people who give, even small amounts or time, often feel happier and more connected to their community. Money’s real value shows up when it’s used to help others, not just ourselves.

Essential Money Skills for Young People Schools

Should Teach

It’s not enough to just “know about money”.

Practical, everyday skills make all the difference. Here are some of the most important money lessons we should all learn early on, but often don’t.

The Magic of Compound Interest

One thing most schools don’t teach? Compound interest.

Learning that money can “work for you”, that what you save today can grow over time, is a game changer. Even small amounts add up, especially when you start young. If you put away a little each week and leave it to grow, you’ll be surprised by how much you have down the line.

Budgeting = Freedom, Not Limitation

Budgeting often sounds like a chore, but it’s really about making conscious choices.

A simple budget helps you see where your money goes so you can spend on what matters most to you, whether that’s a new game, a day out with friends, or saving for something bigger. It’s not about saying “no” to everything, it’s about having the freedom to say “yes” to what you value.

Spotting Scams & Smart Spending

In today’s digital world, it’s vital to be cautious. Learning to spot scams and avoid impulse buys is a modern skill everyone needs. If something sounds too good to be true, it probably is. Taking a moment to double-check before spending can save a lot of trouble later on.

Financial Confidence = Life Confidence

Building good money habits young isn’t about creating future millionaires—it’s about giving young people confidence and control.

Data shows that financial confidence is linked to better mental health and decision-making. The earlier you build these skills, the more prepared you’ll feel for whatever life brings. Even if that’s your first job, uni, or starting your own thing.

What School Doesn’t Teach about about money skills

(But Should)

Imagine if school taught us practical things like:

Instead, most of us leave school knowing how to calculate percentages, but not how to manage a budget or set financial goals.

Why Early Learning Matters

The earlier we start building healthy money habits, the better. Understanding how money works and, more importantly, why it matters, helps us make smarter decisions, avoid stress, and focus on what really matters to us and our communities.

Spotlight: Deborah Meaden’s Books for Young Money Minds

If you want a practical, inspiring way for young people to learn about money, Deborah Meaden’s recent books are a must-read.

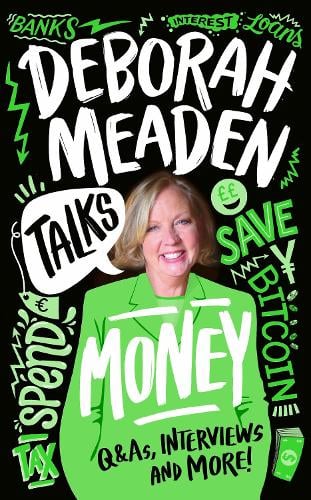

Deborah Meaden Talks Money

In 2024, Deborah released Deborah Meaden Talks Money, a straightforward and empowering guide that breaks down how money works in the real world. With her signature honesty and practical advice, Deborah helps young readers understand earning, saving, spending, and even the pitfalls to watch out for. The book is packed with stories, tips, and answers to the money questions young people actually ask.

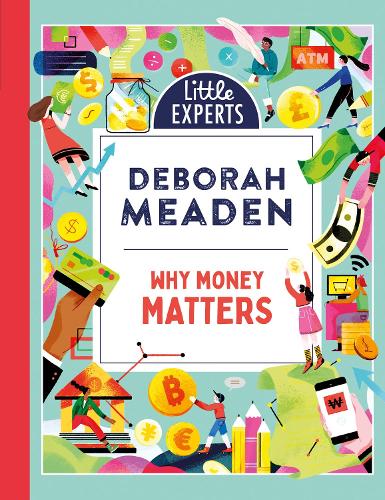

Why Money Matters – Little Experts

Her 2023 book, Why Money Matters, illustrated by Hao Hao, is a bright and engaging introduction to the basics of money—what it is, how we use it, and why it’s important. The book is filled with easy-to-understand explanations and fun illustrations, helping children see that money isn’t just about numbers, but about choices, values, and how we interact with the world.

How inyourroots® is Supporting Money Skills for Young People

At inyourroots®, we believe in empowering young people with real-life skills, not just exam results. Our platform encourages you to:

Track your spending

for one week to see where your money goes and what matters most to you.

Start saving

Set a small savings goal and stick to it for a month.

Give a small amount

(or your time) to a cause or person you care about, and notice how it feels.

Money isn’t everything, but understanding its value and how to use it wisely, can make a huge difference to your future. The earlier we start, the better.

Whether you’re 7 or 27, it’s never too late to learn, contribute, and build habits that help you live life on your own terms.